Commodity Price Volatility Not Surprising In Light Of Current News

Crude Oil:

The Delta variant has become the focus of politicians, the media, and stock and commodity markets. Will it force governments to institute new lockdowns that may take the form of requiring people to be fully vaccinated to participate in everyday life? Although we are on our way to herd immunity, the reaction of politicians to the upturn in COVID-19 cases has been to impose new economic restrictions. That will have an impact on oil demand, especially as lockdowns and more stringent economic restrictions are implemented worldwide.

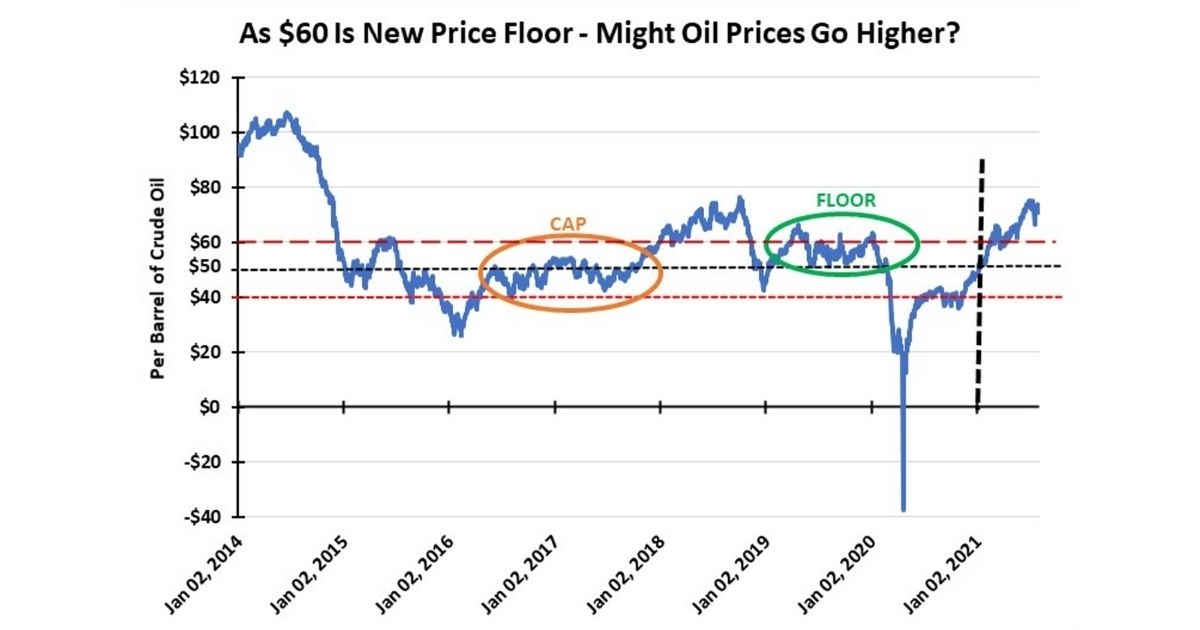

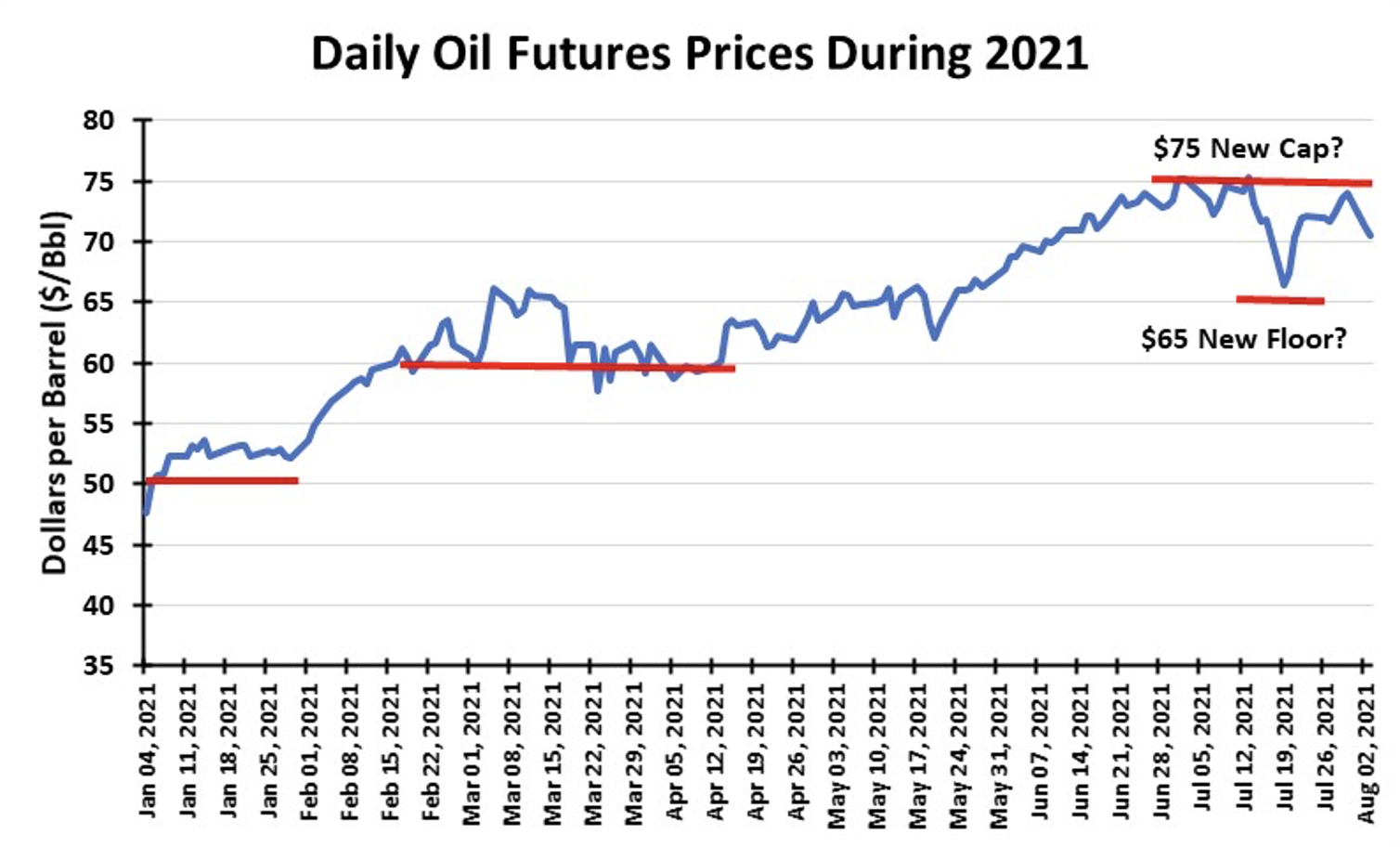

Fear of a slowdown in oil demand’s recovery, or possibly a reversal of recent gains, has commodity traders keying off political utterances about controlling the virus. Our nearby oil price chart for 2021 highlights that oil prices steadily improved until hitting $75 per barrel barrier. Since then, oil prices have become more volatile. Has $75 become the new ceiling? More importantly, is whether $65 is a new price floor.

Fear of a slowdown in oil demand’s recovery, or possibly a reversal of recent gains, has commodity traders keying off political utterances about controlling the virus. Our nearby oil price chart for 2021 highlights that oil prices steadily improved until hitting $75 per barrel barrier. Since then, oil prices have become more volatile. Has $75 become the new ceiling? More importantly, is whether $65 is a new price floor.

Oil price ceilings and floors are tools for assessing support for a current oil price. As evidence the oil demand/supply relationship is strong enough to lift oil prices higher, breaking through a “ceiling price” is seen as a significant confirmation. Usually such a move takes time, the reason why the price threshold becomes known as a “ceiling.” Likewise, when the oil price fails to fall below a price threshold when the demand/supply balance seems weak, it becomes a “price floor.”

We will not speculate on how much the Delta variant will impact oil demand, nor will we focus on the next variant, or the one after that. What we know is that COVID-19 variants will continue emerging and impact economies depending on their transmissibility, degree of contagion and creation of serious health issues. Each time a variant emerges, commodity markets will focus on the global oil demand downside and its impact on prices, rather than the health of the economic recovery. This is only human nature, and oil markets are shaped by humans.

If one were to ignore the Delta variant and only focus on underlying oil demand and supply, we are impressed by two factors. First, the global demand recovery has been quicker than assumed last year. Global mobility has reached or even surpassed 2019 levels in some regions. Only air travel lags, and it is showing strength. On the water, global trade continues rebuilding. Cruising is impacted by government restrictions and hesitation by potential passengers, limiting its recovery.

The other key oil market factor has been the adherence by public oil companies to financial discipline that has limited new well drilling and oil production growth. Moreover, OPEC+ has shown a commitment to limiting the pace of adding new oil supply to the market, which minimizes the risk of a new supply glut anytime soon. All of this suggests higher oil prices on the horizon. The timing will be dictated by COVID-19 variants.

Natural Gas:

Natural Gas:

Natural gas markets have struggled to balance demand (consumption driven by air conditioning during extreme heat waves and LNG exports) and supply (constrained by producers adhering to financial discipline and not drilling new gas wells, producing less associated gas from oil wells, and valuing returning cash to shareholders rather than growing assets and production). None of these factors look to pressure gas prices either higher or lower in the foreseeable future.

The massive heat domes that gripped the Pacific Northwest and Southwest in late June, are gone. In the Northeast, July was wetter than normal and temperatures moderate. As a result, gas demand for generating electricity eased, especially when gas prices jumped to $4 per thousand cubic feet. At that price, cheaper coal regained some lost market share.

LNG exports have been a bright spot for gas, as international prices, driven up by winter-depleted storage and a hotter spring strained electricity grids in Europe and Asia forcing them to use more coal and gas because renewables failed to deliver the power expected. Higher prices boosted LNG profit margins, leading to increased cargoes offsetting weak power generation demand.

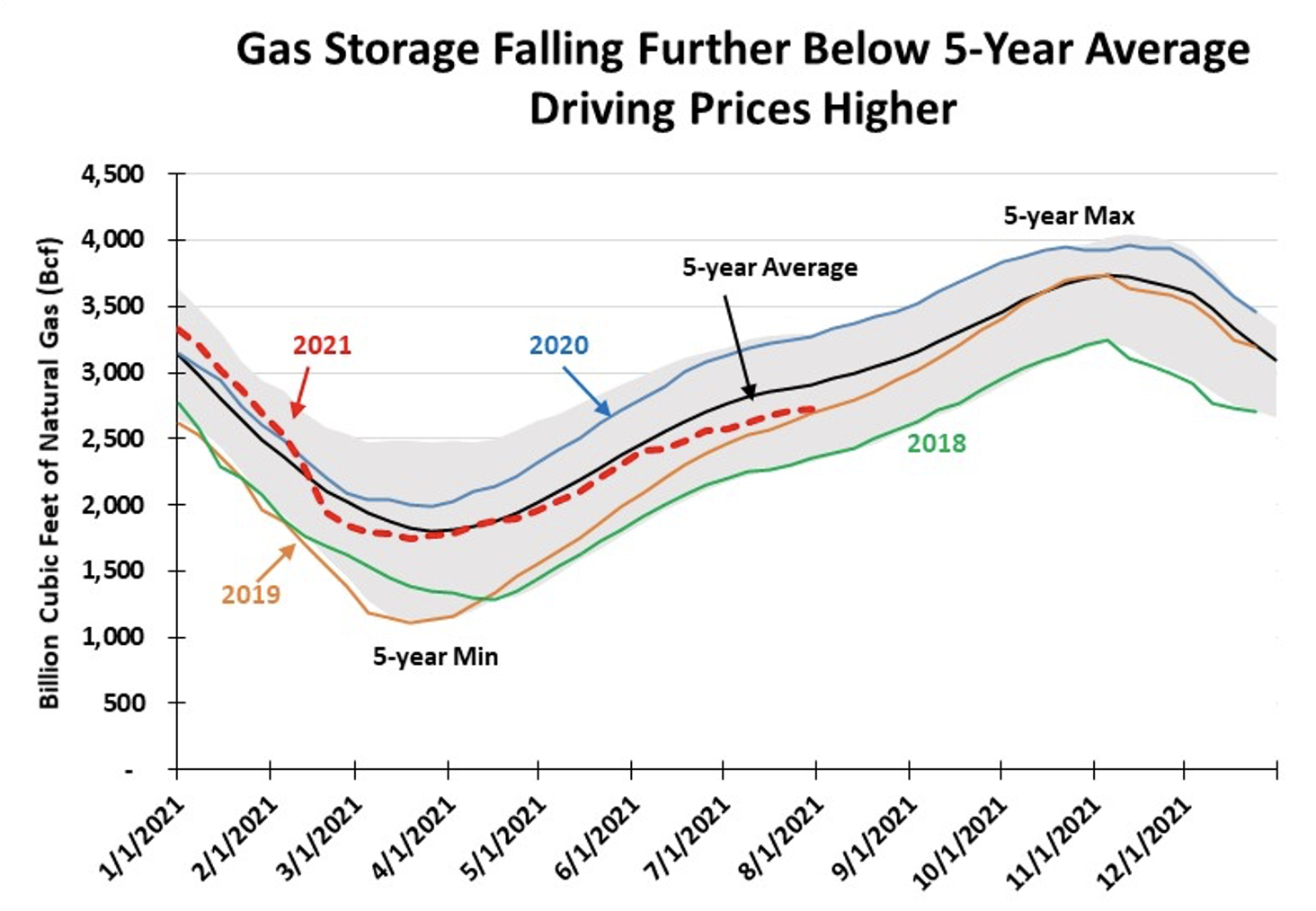

Domestic gas output is growing slowly, as expected. Because storage is trending below the 5-year average storage volumes, gas prices are climbing to reverse this trend. The most recent weekly storage report showed a smaller injection than expected, which is bullish for prices as they will need to be higher to coax more gas into storage. At the time of this report, the current storage deficit to last year’s storage was 542 billion cubic feet and 185 Bcf below 5-year average volumes.

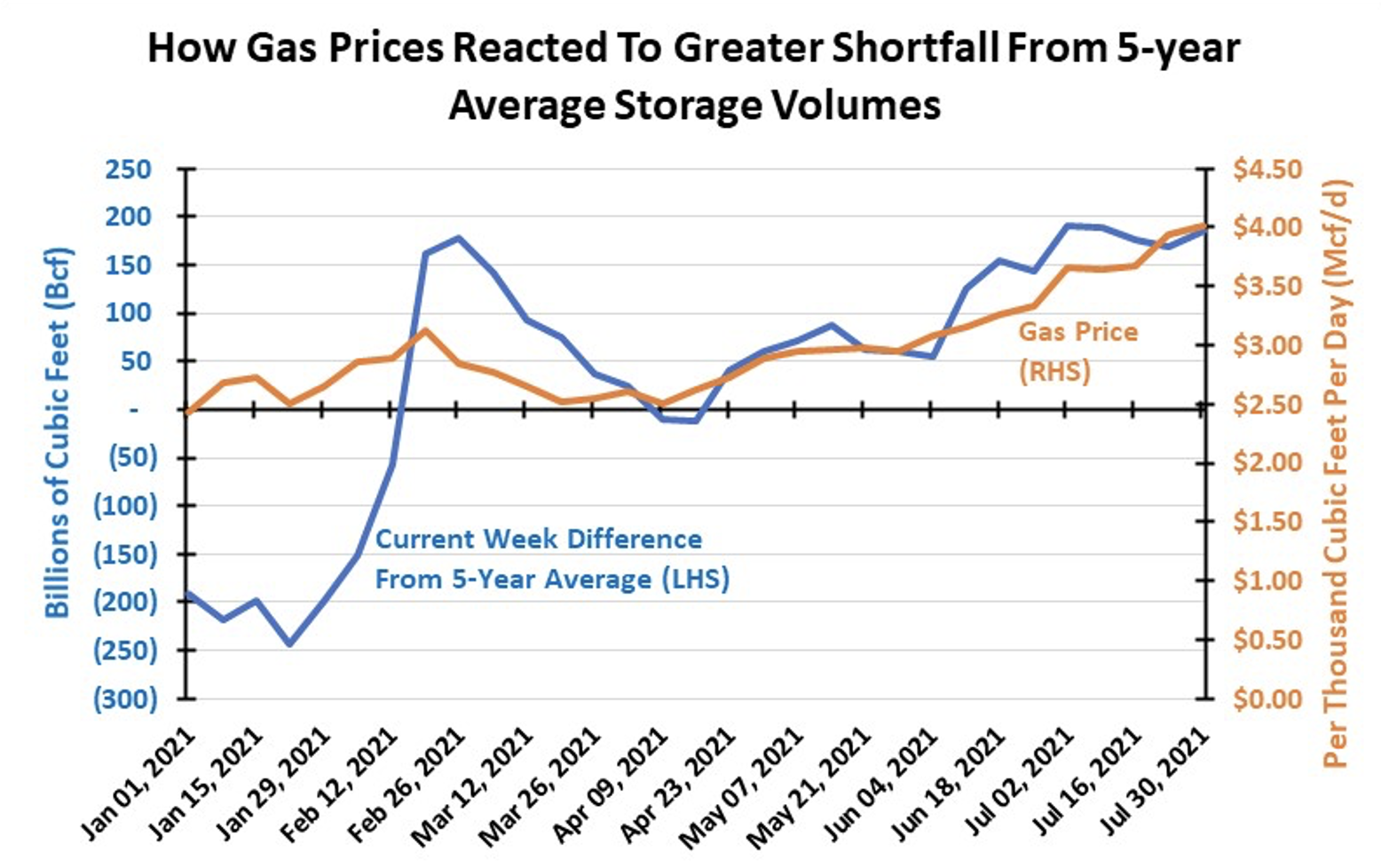

Nearby, we show a chart plotting the difference between 2021 weekly storage volumes and the 5-year average and compared to gas futures prices. The greatest deficit was experienced at the start of July. After narrowing somewhat during July, the latest report showed the deficit had almost returned to the earlier peak. As a result, gas prices reached $3.65/Mcf at the time of the earlier peak in early June before flatlining for three weeks while the deficit shrank. With a widening deficit, gas prices jumped, crossing the $4/Mcf threshold. They climbed even higher in early August, before retreating when the latest storage report was issued. The price decline suggests the market believes they are high enough to rebuild storage heading into winter.

Nearby, we show a chart plotting the difference between 2021 weekly storage volumes and the 5-year average and compared to gas futures prices. The greatest deficit was experienced at the start of July. After narrowing somewhat during July, the latest report showed the deficit had almost returned to the earlier peak. As a result, gas prices reached $3.65/Mcf at the time of the earlier peak in early June before flatlining for three weeks while the deficit shrank. With a widening deficit, gas prices jumped, crossing the $4/Mcf threshold. They climbed even higher in early August, before retreating when the latest storage report was issued. The price decline suggests the market believes they are high enough to rebuild storage heading into winter.

A $4/Mcf price was last seen in late 2016. Since then, natural gas has been the least-respected fuel in the energy mix, often fighting to keep prices from sinking to new lows. Does breaking the $4/Mcf barrier mark the start of a new era for gas? Only time will tell.

By G. Allen Brooks

Featured in ON&T August 2021