Commodity Market Volatility Continues

Crude Oil:

Crude oil markets remain turbulent due to surging worldwide Delta variant COVID-19 cases causing governments to reimpose economic restrictions. When these cases began climbing in late July, commodity markets started worrying about the healthy economic recovery forecasts suggesting strong demand for energy. Whenever markets concern themselves with whether conventional forecasts need to be thrown in the trash heap, commodity prices suffer. That is exactly what has happened to oil prices.

After extensive negotiations between Abu Dhabi and Saudi Arabia, leading OPEC producers, the OPEC+ group agreed to begin restoring the output it was forced to cut in the spring of 2020 when COVID-19 caused a global economic collapse. OPEC+ plans to restore 400,000 per day each month until spring 2022, at which time the full production cut will be restored. At that point, the U.S. will be the only oil supplier not back to pre-pandemic levels.

Despite no U.S. production recovery, the global oil market should be adequately supplied in 2022. That is not the commodity market’s focus currently. It is worried about the impact from Hurricane Ida that slammed Louisiana and its oil and gas infrastructure. Producing and refining operations are out of service for an unknown time. Refineries in Louisiana supply 13 percent of the nation’s gasoline supply. The storm damage will disrupt energy demand and economic scenarios. Overall, Ida has created unknowns, and we know commodity markets hate unknowns.

Despite no U.S. production recovery, the global oil market should be adequately supplied in 2022. That is not the commodity market’s focus currently. It is worried about the impact from Hurricane Ida that slammed Louisiana and its oil and gas infrastructure. Producing and refining operations are out of service for an unknown time. Refineries in Louisiana supply 13 percent of the nation’s gasoline supply. The storm damage will disrupt energy demand and economic scenarios. Overall, Ida has created unknowns, and we know commodity markets hate unknowns.

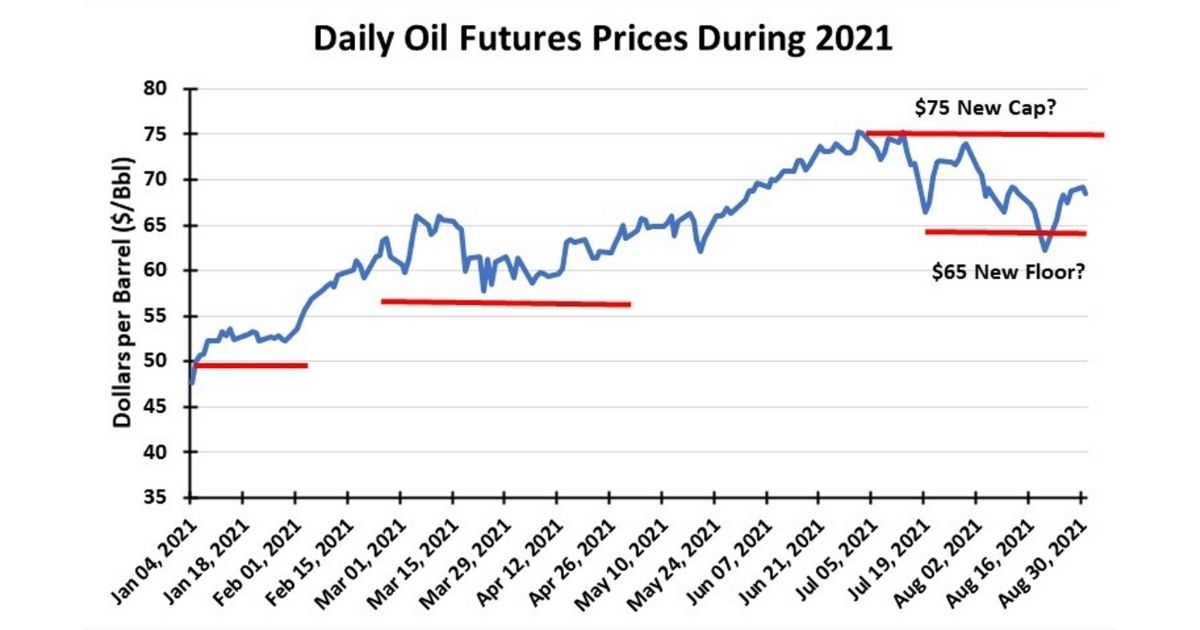

Although WTI has fallen from the upper $70s a barrel price range to as low as $63, prices have bounced back to $70. Oil in the $65 to $70 a barrel range is profitable—upper $70s even more so. Producers continue exercising financial discipline, only putting 50 oil drilling rigs back to work since June when oil prices broke the $70 barrier. Although higher, the oil rig count is down 325 rigs from 2019’s level.

Commodity traders remain focused on near-term price volatility, which allows them to trade profitably. Oil company executives and energy strategists, however, are interested in long-term issues. The overriding one: When does global oil demand peak? The second question: How rapidly will oil consumption fall? The answers will impact where oil prices trade over the next several years. The UN’s COP26 climate change meeting in early November may provide some perspective. Will governments commit to end oil’s use or only pledge to do so? How sincere will these pledges be? Oil price volatility is unlikely to end anytime soon.

Natural Gas:

Natural Gas:

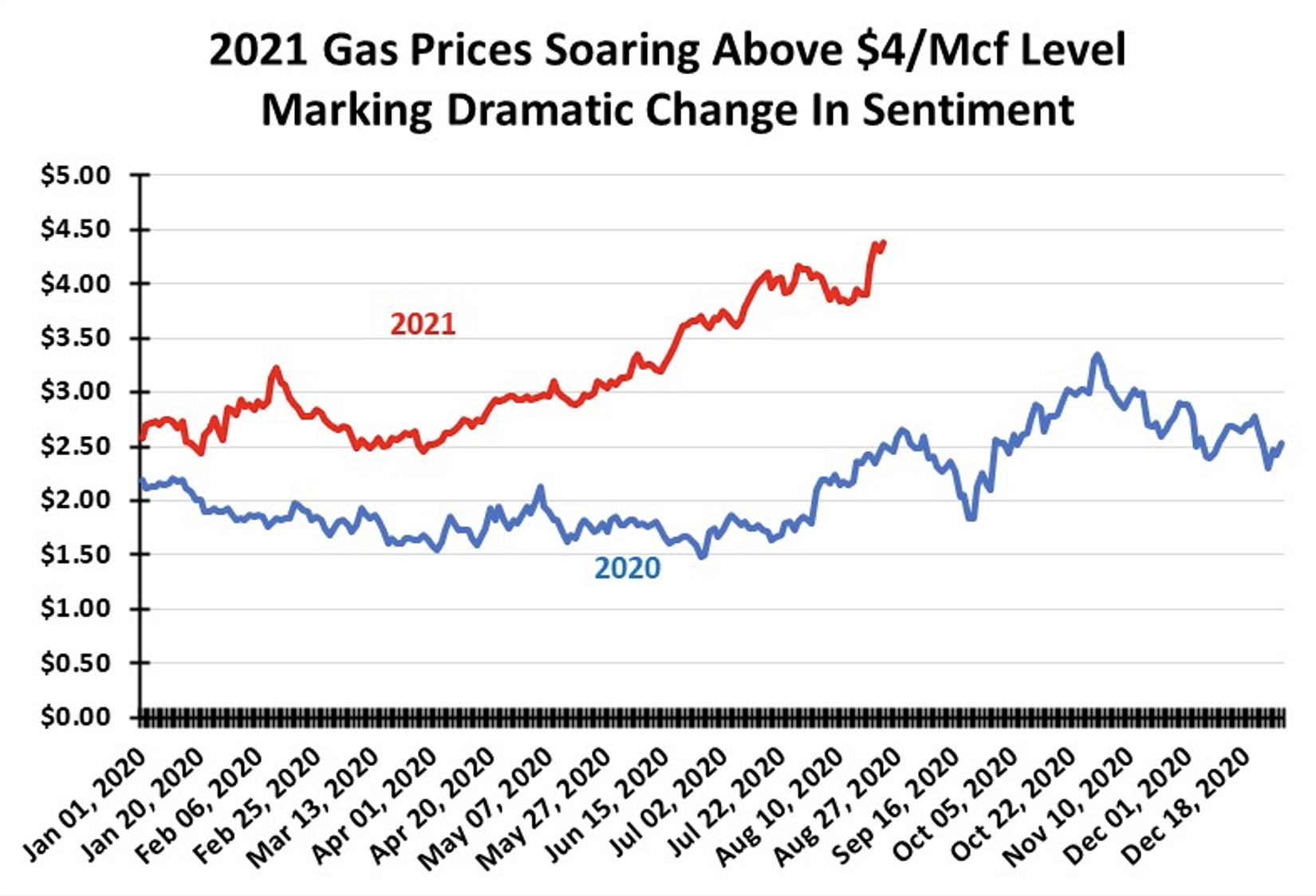

In our last column, we asked whether natural gas, breaking through the $4/Mcf barrier, was entering a new era? We suggested only time would provide the answer. We now have our answer: Yes. Natural gas futures prices are trading at $4.65/Mcf as this column is written.

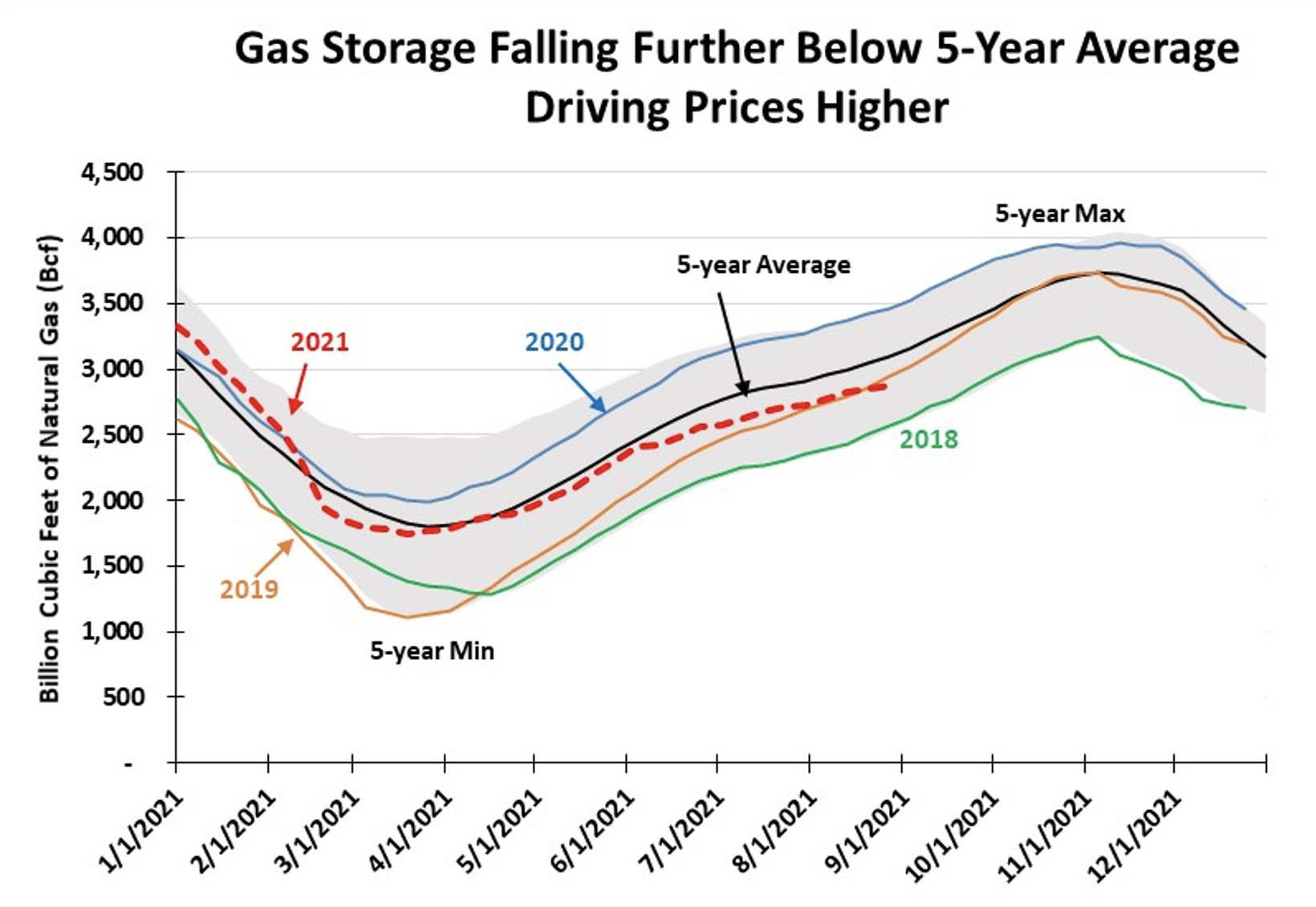

Natural gas prices reflect the reality that storage is not filling as rapidly as expected earlier, and now prospects are we will finish the injection season with a meaningful supply deficit to last year. Gas storage is 579 Bcf behind last year’s storage volume, but more troubling is that it is 222 Bcf behind the 5-year average. We don’t know about the upcoming winter. Will it be another warm one, in keeping with global warming, or will it be cold? Even warm winters can experience polar vortexes that plunge large portions of the United States into extremely cold temperatures, draining gas storage rapidly. The storage situation presents a troubling outlook at the start of September.

With Europe also experiencing a natural gas supply shortage, continental gas prices are at record highs. Gas usage in Europe is up, as renewables, primarily wind, have failed to deliver anticipated power supplies due to low wind speeds. This has forced European utilities to restart coal-fired power plants, besides using more gas peaking capacity. Compounding the European gas market is that domestic supplies—the North Sea and the Netherlands—are in decline. That means greater dependence on Russian gas supplies. Although capacity to deliver gas to Europe will increase when the Nord Stream 2 pipeline connecting Russia and Germany is completed, the problem is Gazprom has not ramped up its production. More delivery capacity handling the same volumes only means reduced pipeline capacity utilizations.

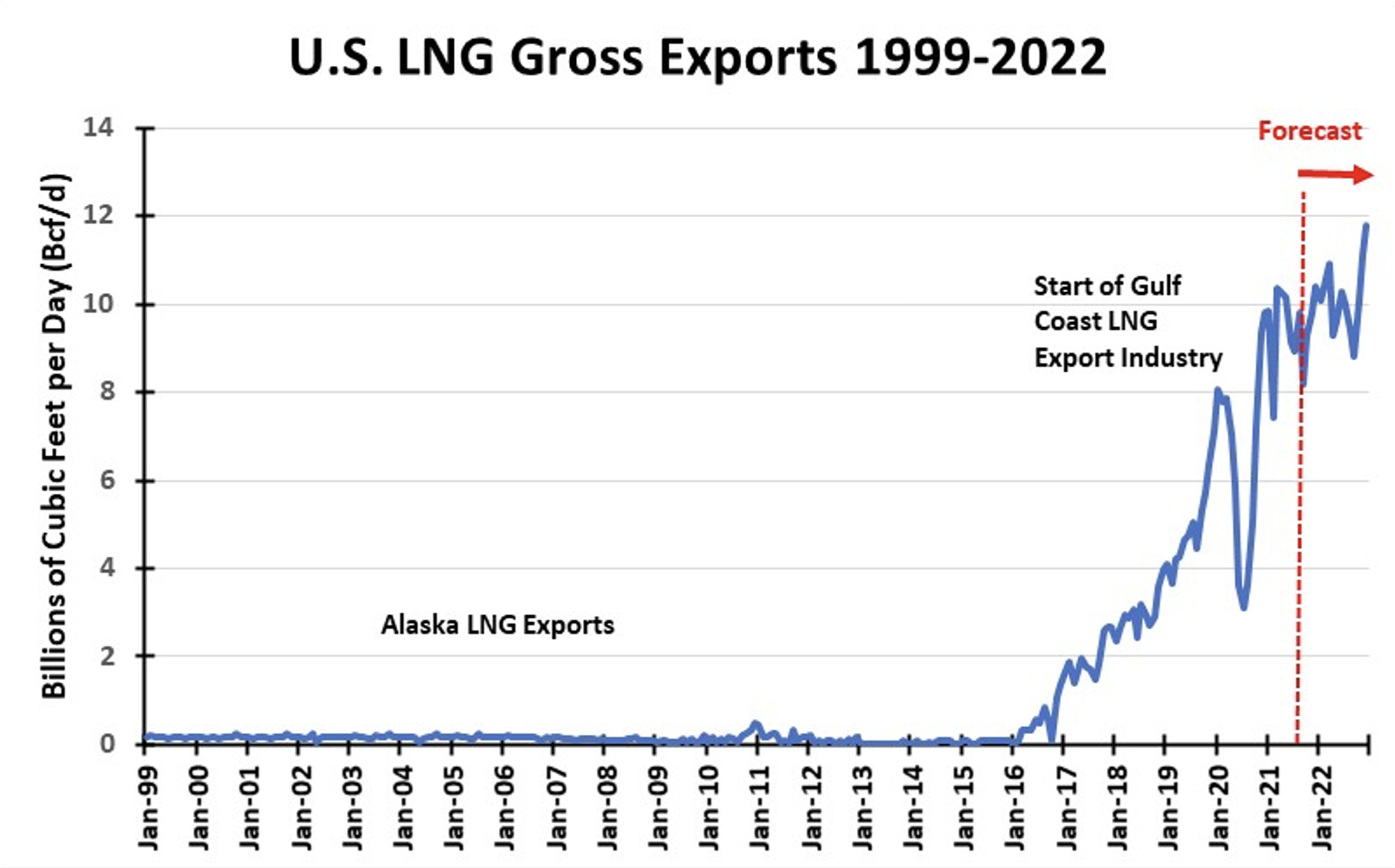

In the meantime, Europe is competing with Asia and China for U.S. LNG supplies from the U.S. Despite higher domestic gas prices, U.S. LNG shippers stand to earn greater profits supplying world markets. It explains why more LNG volumes are being shipped, and new terminals are operating, and more are planned.

In the meantime, Europe is competing with Asia and China for U.S. LNG supplies from the U.S. Despite higher domestic gas prices, U.S. LNG shippers stand to earn greater profits supplying world markets. It explains why more LNG volumes are being shipped, and new terminals are operating, and more are planned.

Cat 4 Hurricane Ida has ravished Louisiana, shutting down Gulf of Mexico gas supply until damage assessments can be made and repairs completed. For a while, there will be reduced supplies of natural gas for domestic consumption and LNG shipments. This will likely push natural gas prices up. Higher prices are needed to drive reluctant E&P companies to restart more gas-oriented drilling rigs and boost production. The problem is that new drilling efforts will not deliver more supply for 4-6 months after rigs start drilling. A new worry is that some producing basins may be entering declines with long-term supply implications.

For all the attention paid to crude oil prices with their global implications, the under-appreciated fuel is natural gas. It is a key player in our fight against climate change by displacing coal in electric generation, delivering supply to world markets, and supporting our petrochemical industry, as well as heating American homes this winter. Natural gas may soon be getting the respect it lacked during the past decade.

By G. Allen Brooks

Featured in ON&T September 2021