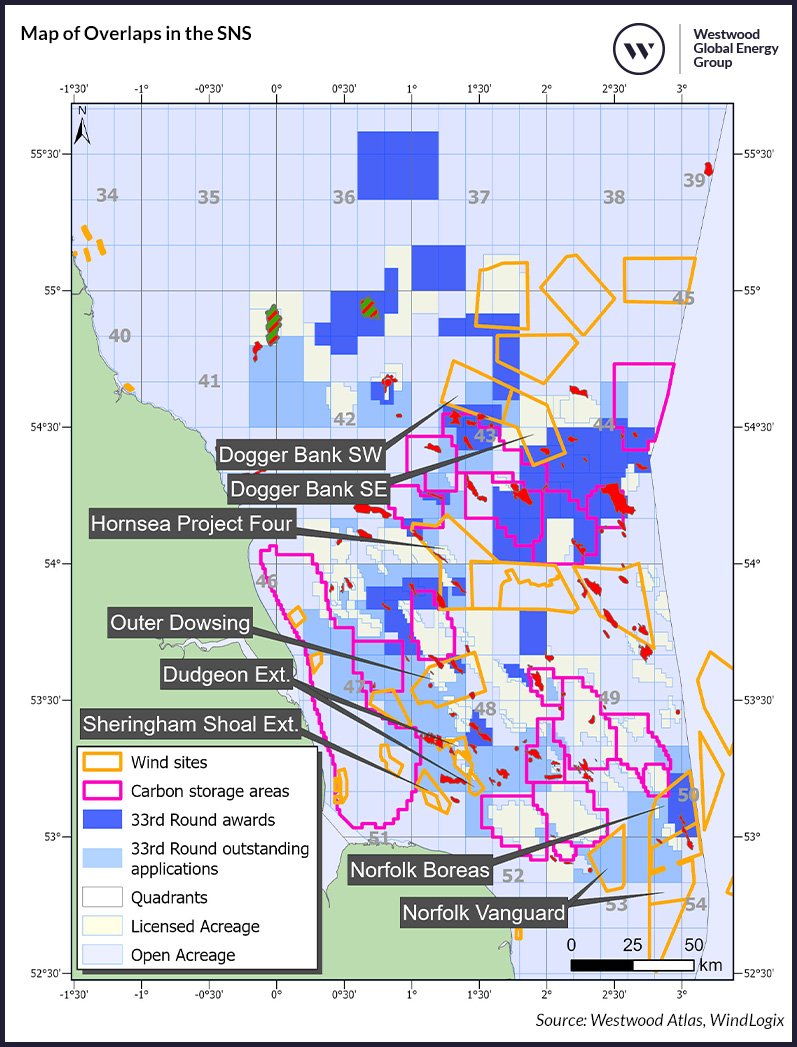

The SNS and EIS were already congested due to carbon storage licenses lying near or overlapping offshore wind farm sites. These oil and gas (O&G) licenses add to this congestion, creating additional competition for the seabed. As a result of this, a new clause, “Relationship with Windfarms”, has been introduced, which relates to O&G license awards that either overlap with offshore wind lease sites or are within 500 m of existing wind farms. Under this clause, the O&G licensee must enter into a co-location agreement with the offshore wind lease holder before undertaking any activity.

Figure 1: Map of Overlaps in the Southern North Sea. (Image credit: Westwood Atlas, WindLogix)

Overlapping Issues

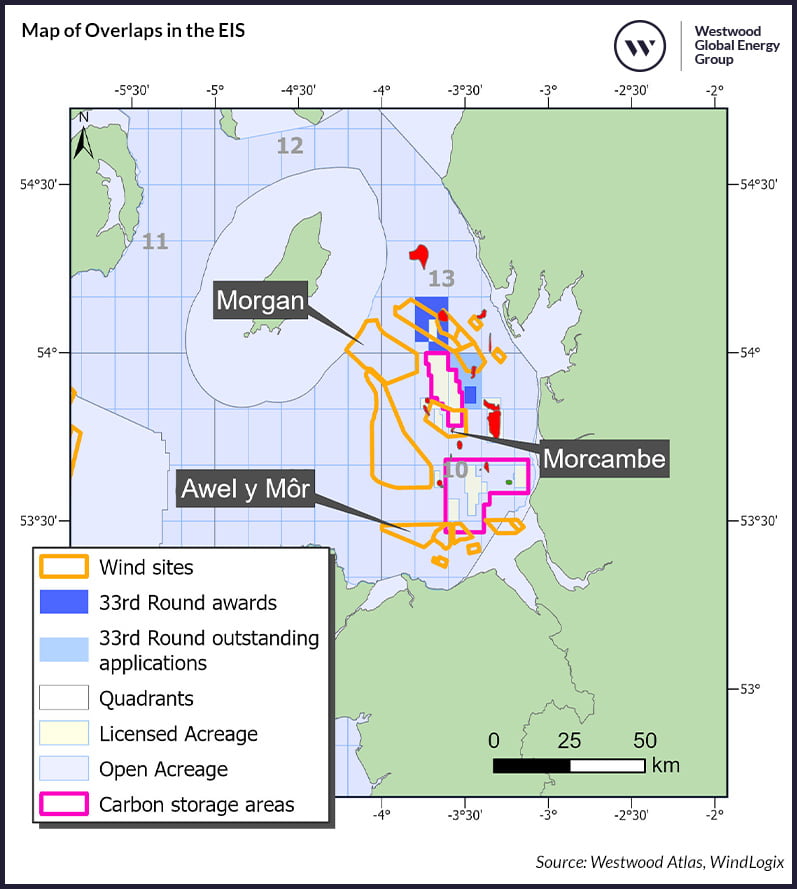

Although the addition of this clause is a good first step, further legislation will be required to ensure that overlapping projects do not delay each other. In total, 31 offshore wind projects overlap or are near either carbon storage or O&G licenses in the SNS and EIS. A breakdown of the current status of offshore wind projects in the SNS shows that 11 offshore wind projects are operational, three projects have a status of EPCI and eight have a status of planning. Six operational wind farms and three planning projects make up the projects in the EIS.

The wind farms that currently have a status of planning (as highlighted in Figure 1 and Figure 2) are the primary projects that will need to navigate any potential issues that may arise due to co-location. Site assessments and construction activities at these wind farm areas may clash with planned activity at the awarded O&G and carbon storage sites, as drilling equipment and pipelines can potentially interfere with the placement and operation of wind turbines. Examples of such overlaps include the Dogger Bank South wind farm being planned in the north of the INEOS-operated Greater Pegasus area and the Outer Dowsing project, which overlaps with the Perenco-operated Olympus discovery, where a firm well is planned. In addition, the Norfolk Boreas wind farm overlaps the Orcadian-operated blocks that include the 50/26b-6 Earlham discovery, which it plans to develop as a gas-to-wire project connected to the wind farm.

Furthermore, co-location clashes may also occur when it comes to operations and maintenance (O&M) activity on an operational wind farm, as marine space will be required for vessels to navigate around the infrastructure that is put in place for O&G and carbon storage projects. Careful marine planning guidance will be required to ensure that all projects can operate without hindrance, reducing the risk of disputes that can delay project development timelines.

Figure 2: Map of Overlaps in the East Irish Sea. (Image credit: Westwood Atlas, WindLogix)

We have already witnessed a dispute over an overlapping zone in the SNS between the BP-led Northern Endurance carbon capture, usage, and storage project and Ørsted’s Hornsea Project Four wind farm, which took two years for the two parties to resolve. The developers of the two projects entered into an Interface Agreement in 2013 to “regulate and co-ordinate their activities with a view to managing potential and resolving actual conflicts.” However, the dispute still occurred. It resulted in a five-month delay to the Development Consent Order (DCO) for the wind farm, further highlighting that reliance upon an agreement between parties may not go far enough.

Turning Challenges into Opportunities

While the spatial overlap in the SNS and EIS poses significant operational challenges, it also opens avenues for innovation and collaboration. Electrification of platforms via wind farms on shared sites could present an alternative route to market for offshore wind projects. Rather than constructing export cables to shore and waiting for grid upgrades to connect wind farms, the developers of the projects highlighted on the map could seek to strike a deal with the O&G license holder, supplying power to their infrastructure via the wind farms. This would also be advantageous for the O&G developers as power from these wind farms would help them to reduce their production costs and, most importantly, emissions.

Moreover, collaboration between project developers across overlapping areas could take place by sharing data on the characteristics of the site and potentially utilizing the same supply chain companies for similar activities. Geological and geophysical surveys, as well as environmental assessments, are required for all three types of projects, creating a potential area for these synergies. Furthermore, both wind and O&G projects utilize similar components such as foundations, topsides, and power cables, creating an additional area in which they could coordinate on timings for installation activity, contracting the same company to undertake installations for both types of projects across the shared site.

Enhancing Efficiency and Reducing Conflicts

To mitigate conflicts arising from the overlapping use of marine space in the SNS and EIS, it is crucial to implement comprehensive marine spatial planning and enforce stricter regulations beyond the current clause introduced. Promoting collaboration between offshore wind, O&G, and carbon storage project developers can enhance efficiency, reduce emissions, and streamline operations through shared infrastructure and data. These solutions can ensure that the development of these essential projects proceeds smoothly and without unnecessary delays. In turn, this can help the UK to meet its energy goals while minimizing conflicts and maximizing the benefits of shared marine resources.