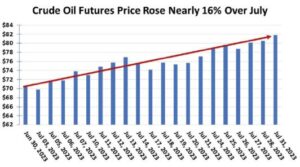

In the first half of this year, oil prices struggled, and experienced periods of downward pressure whenever traders became convinced global oil demand would be weak. Traders would sell oil futures short and cut their holdings. Recently, they scrambled to cover their short positions and begin buying contracts as they sensed global oil market dynamics becoming more favorable. This is part of the reason why oil prices have strengthened.

The earlier oil price struggle was because China’s economic reopening after COVID-19 proved weaker and bumpier than expected. Now, China is aggressively stimulating its economy. Oil imports are up as well as inventories. China used the earlier price weakness to purchase cheap oil that can be used to dampen inflationary pressures arising from today’s higher prices.

Higher oil prices also have foiled the Biden administration’s efforts to restock the Strategic Petroleum Reserve drained last year to keep gasoline and heating oil prices down. In June, the administration sought to buy six million barrels for the SPR when prices were below $70. With higher prices, the government canceled its bid request.

What can we expect from the oil market as we end summer and enter fall? First, we are fast approaching the peak in the hurricane season that can disrupt Gulf of Mexico oil production and tankers bringing in petroleum cargo. Secondly, US drilling activity fell as oil prices weakened. Thus, fewer barrels of new oil reserves have been discovered, limiting our ability to meet future demand. Thus, we can expect upward pressure on oil prices.

Other oil market dynamics include Saudi Arabia’s announcement it will continue through September its one-million-barrel-a-day production cutback. Fellow OPEC+ member Russia is also keeping its 500,000 b/d output cut in place. Finally, a consensus is emerging that the US will avoid a recession in 2023 and maybe in 2024, thereby reducing the possibility of weaker oil demand from lower economic activity.

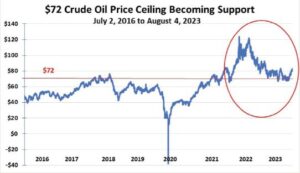

Support for higher oil prices is shown by the price activity around the $72 line in our accompanying chart. Oil prices remain steadfast at that level. As history shows, when oil prices fall to that support level, they then tend to rise. Hold on to your wallets because you will be facing higher gasoline and diesel prices.

NATURAL GAS

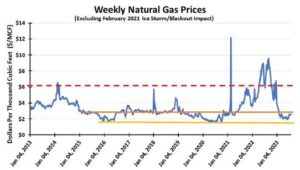

The story of natural gas is about heat and liquefied natural gas exports. The heat dome that descended over the southern half of the US generated days and weeks of record-high temperatures. Hot temperatures challenged electricity grids, increasing dependence on natural gas plants for their output. Numerous regional grid operators warned customers to cut electricity use to prevent blackouts. Fortunately, the warnings were heeded, and blackouts were avoided.

LNG exports in July rebounded by nine percent over June volumes as the industry completed its maintenance work on terminals. During July, the US exported 7.44 million tons (380 million cubic feet per day) of LNG, of which 43 percent went to Europe, 36 percent to Asia, 10 percent to Latin America, and two percent to the Middle East, according to Refinitiv data. The latest data showed that while Europe was the primary recipient of LNG exports, its share of total exports fell from 52 to 43 percent between June and July, while Asia’s share rose from 20 to 36 percent. These trends demonstrate how Europe’s current high gas storage volumes reduced buyer interest in LNG. On the other hand, Asia’s increased economic activity supported increased LNG purchases.

The first half of 2023 saw three new US export terminal approvals with a combined 5.1 billion cubic feet per day of output. This is the largest annual approval since 2014 when the industry approved three terminals with a combined 4.9 bcfd capacity. The current industry export capacity is 13.8 bcfd, so the expansions will add substantial volumes. These terminal approvals come on top of the four currently under construction with a combined output of 8.6 bcfd. The industry is optimistic another two terminals will be approved for construction before the end of 2023, adding 1.4 bcfd of additional export capacity. With projections for 2035 global LNG demand reaching 627 million tons, up from 399 million tons in 2022, according to S&P Global Commodity, the race is on between the US and Qatar to be the world’s number one exporter. The clear beneficiaries of this race will be the suppliers of LNG equipment and services, as well as the construction companies needed to build them.

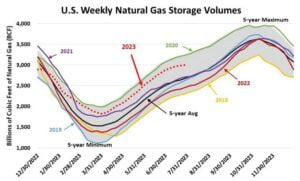

A big question is whether the US natural gas industry can satisfy the growing demand from electricity and LNG customers. The E&P industry is confident it has the technology and capital needed and that the nation has the resource potential to meet future demand. Even in our current weak gas price phase, production continues growing. At the end of July, year-over-year gas production grew three percent to 102.5 bcfd. Combined with the 6.1 bcfd from Canada, the gas supply met LNG and Mexican pipeline export requirements, while also adding to domestic storage for the upcoming winter. These dynamics suggest gas prices should strengthen, but not soar as we move into fall.

This story was originally featured in ON&T Magazine’s August 2023 issue. Click here to read more.