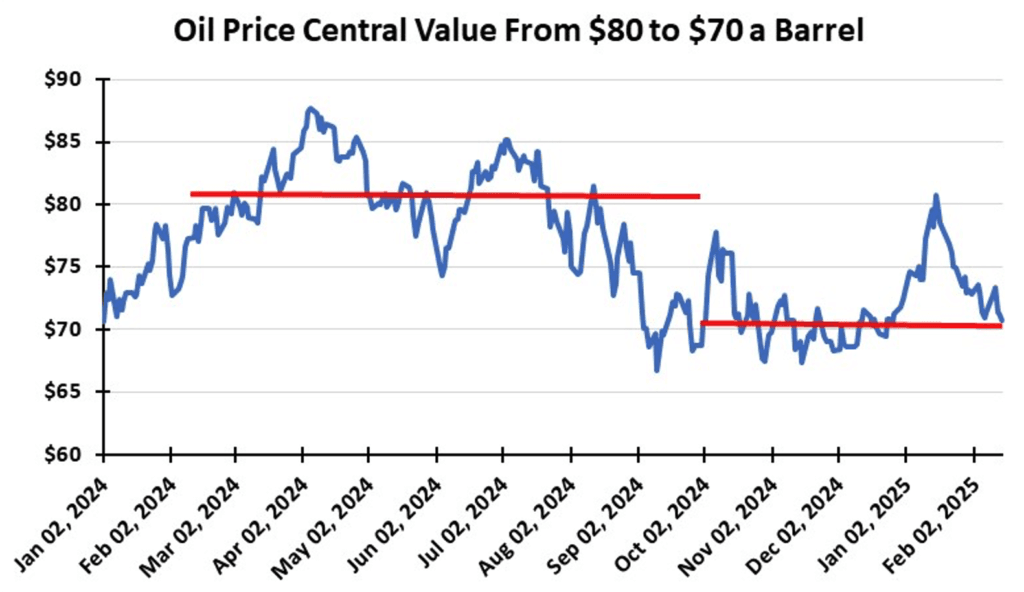

As Trump prepared to enter the White House, he said he wanted OPEC to lower its oil prices, a plea they rejected. Why would they sacrifice their economic health to support the new US government? At the same time, oil producers in the US quickly said they would not begin a massive drilling effort, even as crude oil prices climbed toward $80 a barrel. Managers have learned that sacrificing capital discipline and sending surplus cash back to shareholders is more damaging than bragging rights over daily production gains.

In one of Trump’s early Executive Orders, he levied tariffs on Mexico and Canada, sparking a continental firestorm. Although the Canadian tariffs were lower for its crude oil exports to the US, the domestic oil industry noted that the heavy oil from north of the border was necessary for optimal operation of our refineries. Raising the cost of that oil would boost pump prices in the near term.

Interestingly, Trump acknowledged that his tariff proposals would bring some consumer pain in the short term, but he sees future economic benefits. The Canadian and Mexican tariff tiff evaporated initially with concessions over border control, illegal migrant issues, and stopping fentanyl from entering the US.

Internationally, Trump is also breaking dishware and stirring up the locals, especially in the Middle East. Politicians in the US and abroad struggle to react to the President’s actions. The mainstream media appears lost in understanding Trump’s comments and policies. The theme of Trump’s actions is asking “why we are doing that.” Few leaders coming into office question the status quo, but Trump sees his election as a demand by most Americans to clean out the swamp. An early step was DOGE and its revelations about questionable spending by USAID.

The oil industry suddenly is taking up the DOGE mission within its own companies. Chevron’s announcement that it will lay off 15–20 percent of its global workforce over 2025-2026 shocked many. However, it is consistent with numerous oil companies adjusting strategies, shifting spending focus, cutting unprofitable ventures, and reducing workforces. Making more money consistently is now the objective.

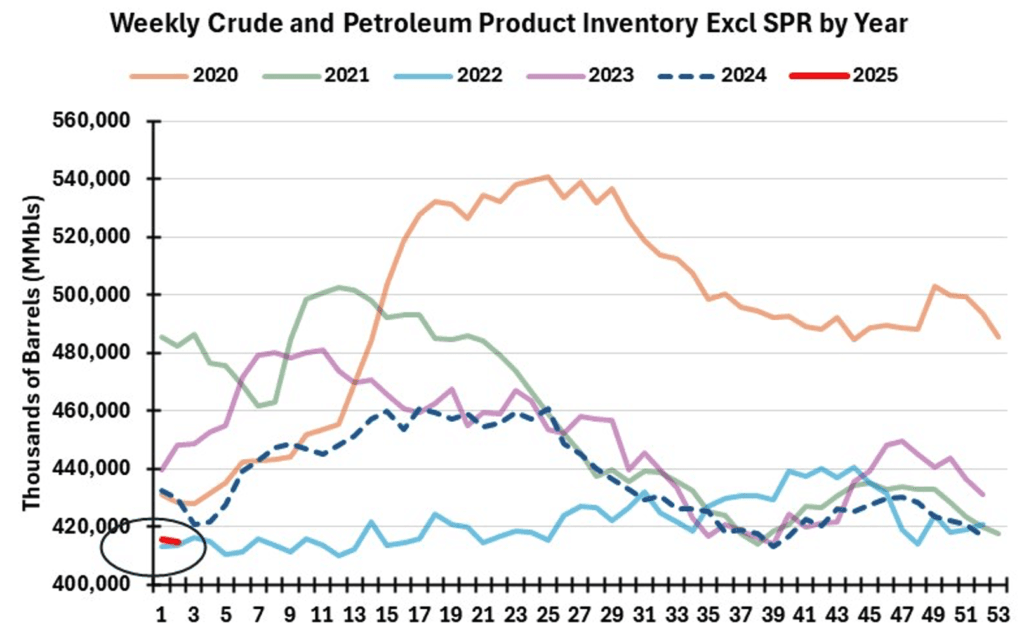

These industry adjustments are occurring as current oil prices sink back to the $70-a-barrel support level of 2024. While uncertainty exists about the future of oil prices, it is interesting that US petroleum inventories are beginning 2025 at low levels similar to 2022. That was when the US economy was recovering, and petroleum demand was growing, but crude oil production contracted by the COVID-19 disruption. Could the industry be looking at higher oil prices later in 2025? If so, it will be demand-driven amid supply constraints, which could stimulate increased US oil drilling.

NATURAL GAS

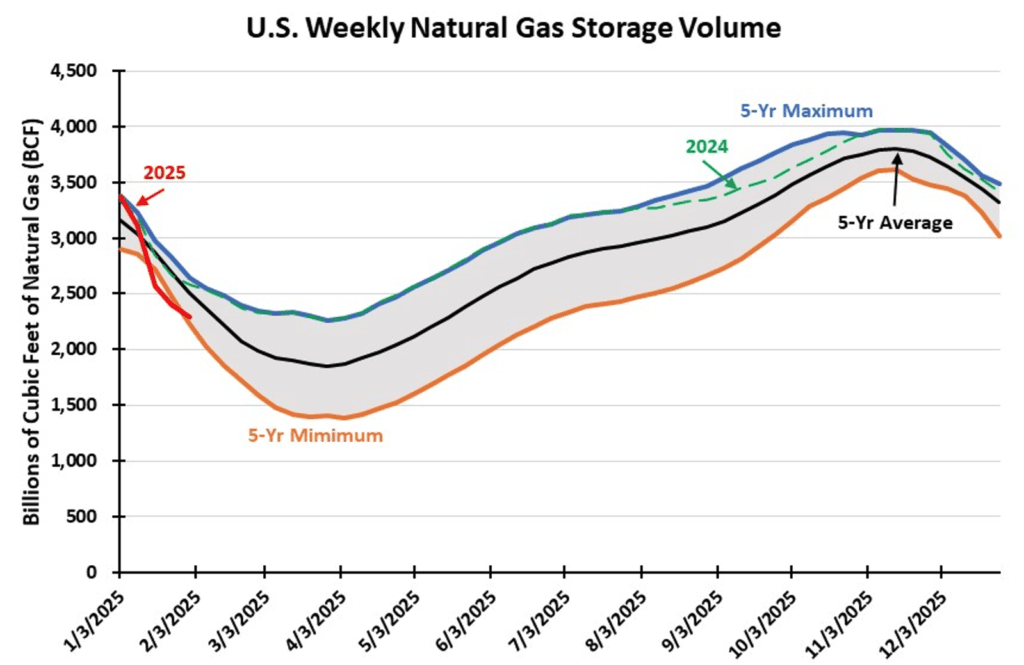

The bitterly cold weather that swept the nation during the second half of January caused a surge in natural gas use. Weekly storage volumes fell below the 5-year minimum, sending gas prices above $4 per thousand cubic feet. Winter weather will remain the controlling variable for gas prices for the next eight weeks. However, gas prices will soon come under the control of longer-term forces impacting the market. Most forces relate to shifting priorities to power our nation as annual electricity demand growth accelerates due to more data centers and artificial intelligence use.

The Trump administration ushered in an era of renewable energy opposition. The President immediately moved to ban offshore wind development, a key agenda item of the Biden administration. Because of limited land and energy resources, New England and Mid-Atlantic states want to use the nation’s offshore waters for future electricity supply regardless of environmental and maritime impacts. Trump will not allow that to happen.

Many mandates and subsidies promoting renewable energy use are also being eliminated. The fallout has electric utilities adjusting their future supply strategies. The challenge is that the increased power demand—annual growth rates not seen since the 1950s and 1960s—is outstripping planned supply additions. With the increased share of renewable energy on power grids, regulators warn of an increased risk of blackouts.

While interest in building, extending, and restarting nuclear power plants is growing, the near-term supply impact is limited. The greater electricity supply coming from new nuclear plants will be a decade or more away. Natural gas-generated electricity will be needed to meet the projected supply shortfall.

As electricity growth demands more natural gas, the Trump rollback of the Biden pause in approving new LNG export terminals adds another demand ingredient to the future gas price outlook. Will “Drill, Baby, Drill” increase natural gas supplies? Sustained higher gas prices will be needed. Those could come if global natural gas demand continues to grow.

The unsettled market in Europe and China’s retaliatory tariff on US LNG have created near-term world gas market turmoil. Will a resolution of the Russia-Ukraine war involve Europe returning to buying Russian pipelined gas? That would reduce global LNG demand, at least temporarily. However, the colder winter has European gas storage inventories well below their target levels, boosting continental gas prices. Once again, winter weather in the Northern Hemisphere controls natural gas prices. Soon, however, gas price control will shift to longer-term market fundamentals.

By Allen Brooks, Senior Fellow of the National Center for Energy Analytics & ON&T Columnist

A FULL VERSION OF THIS COMMENTARY WILL RUN IN THE UPCOMING EDITION OF ON&T, AVAILABLE MARCH 14, 2025. FOR YOUR COMPLEMENTARY COPY, VISIT oceannews.com/subscribe.

FOR FREE AND UNLIMITED ACCESS TO OUR ARCHIVE OF MONTH-BY-MONTH OIL AND GAS COMMENTARY, VISIT oceannews.com/frontline