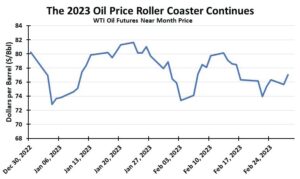

A slowing economy will sap oil demand. So far, there are few signs a significant recession is imminent. On days investors believe a recession is near, they push oil prices down. Whenever they believe a recession is unlikely this year, they bid up oil prices. February provided a lesson on the yin-yang of oil prices and recession sentiment. From the start to the end of the money, oil prices declined about two percent from $78.87 to $77.05 a barrel. In the first three days of February, the oil price fell seven percent or nearly $4.50 but over the next 10 days it climbed by nearly $7 a barrel. After climbing above $80, nine days later the price had dropped by $6 but then rallied by $3 to end the month. The oil price volatility closely tracked the release of economic data initially showing a weak labor market, which was then offset by strong consumer spending data. Higher inflation data was offset by stronger manufacturing data. The month ended with worse inflation news, but a new dynamic entered the oil price equation— China.

On the world stage, oil prices are driven by the issue of how strongly and quickly China’s economy will recover from its multi-year lockdown. China’s economic data is always distorted in the early months of the year because of the nation’s New Year’s Celebration. This year’s data may be more distorted by the economic reopening at the same time as the holiday, but if investors see an upward trajectory for China’s oil demand, prices will continue to move higher.

The wildcard for the global oil market is the sanctions on Russia’s crude oil and refined products, the latter having only been implemented in early February. Russia has cut its oil output by 500,000 barrels per day but continues finding consumers for its supply. The unknown is how the world adjusts to the loss of Russia’s substantial supply of diesel fuel, especially for Europe. It is a major problem for Europe, whose refineries do not produce sufficient diesel to meet demand. Russia’s diesel output is going to other countries, some of which will likely be transshipped to European customers. While global oil markets are disrupted, new shipping and trading patterns are evolving, but they will be less efficient and more costly than previous patterns.

Investors and traders should watch China’s economic data, prospects for US and Europe recessions, and geopolitical events, as these issues are likely to move oil prices, at least in the short term. Long-term, the question is how fast the energy transition may erode oil consumption. But as bp’s CEO Bernard Looney confirmed, oil’s use will be greater and be needed for longer than he had predicted two years ago. Oil is what powers the world’s economy and delivers life’s improvements. That reality is now being acknowledged.

NATURAL GAS

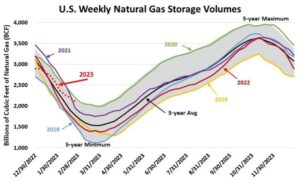

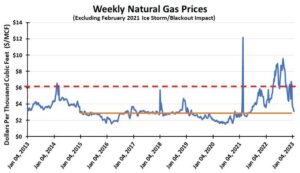

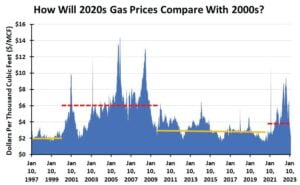

Natural gas prices have fallen like a rock so far in 2023 as warm weather both here and in Europe has sharply curtailed consumption. The European demand drop reflects both warmer winter temperatures and consumption cutbacks managed by civilians and businesses in response to higher prices and warnings of an extended energy crisis. Fear of a cold winter and sky-high gas prices had prompted people to reduce thermostat settings to ease their financial pain. In Europe, last summer and fall, the need to fill gas storage to the brim to ensure adequate supply for a cold winter had driven up prices. High prices cut current gas use and entice producers to send gas into storage caverns. The United States experienced a similar response. The difference between Europe and the US is the latter’s natural gas production. According to the Energy Information Administration, recent weekly US natural gas production averaged about 113 billion cubic feet a day, up five percent from a year ago. Growing output has come as demand remained relatively flat year-over-year, leading to sharply lower gas prices.

When we examine the weekly gas storage chart, we see how 2023’s volumes have increased sharply compared to the 5-year average volume. Since the beginning of 2023, storage has gone from one percent below the 5-year average to 19 percent above. Compared to last year, the increase has been greater, going from a five percent deficit to a 27 percent surplus. Putting the numbers into perspective relative to total storage volumes, the deficit from the 5-year and 2022 levels have added 342 and 451 billion cubic feet to storage. Those volumes compare with total gas storage for the week ending February 24, 2023, of 2,114 billion cubic feet. These numbers explain why natural gas prices have been falling like a rock this year (see accompanying chart).

For one day recently, Henry Hub natural gas futures traded below $2 per thousand cubic feet. As a winter storm rolled across the United States, gas prices rallied from the $2 level to around $2.80. That put gas prices at about the level experienced during the 2020-21 winter but well below last winter’s prices. Natural gas prices are likely not to rally further, even with all LNG export terminals operating, because we are approaching the end of the winter heating season. Europe’s warm winter has dulled its need to purchase US LNG, which had pushed gas prices up last year. Once again, Mother Nature has thrown a curveball at energy markets.

This story was originally featured in ON&T Magazine’s March 2023 issue. Click here to read more.