When Iran sent 200 drones and 100 missiles against Israel, it and its allies were prepared and successfully destroyed almost every weapon sent. Yes, the Iranians had told Türkiye about its plans to attack and its hopes for a de-escalated response from Israel. Israel’s response proved tactical, targeted, and tempered.

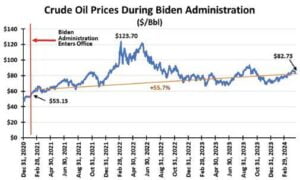

The record of oil prices from late March to mid-April showed just how much prices were influenced by geopolitical developments. WTI futures were trading in the mid-$81 a barrel range until the end of March when Israel launched an attack on the Iranian consulate in Damascus, Syria. Seven people died, including a top Iranian commander and his deputy. Oil prices jumped and climbed to $87 as traders awaited Iran’s response. Following Iran’s attack, oil prices fell as it became apparent World War III was not starting.

Are oil prices poised to collapse? If the Middle East powder keg is not about to blow up, the geopolitical risk factor in oil prices disappears. We are back to focusing on economic activity and trends in oil consumption and global oil supply. Downward price pressure could come at the end of May when we start the US driving season— a seasonal peak in consumption.

Globally, China’s latest economic data came in stronger than projected, but investors are unconvinced it will continue and lead to higher energy use. Recently, the International Monetary Fund revised its global economic growth projection higher, which should be positive for oil demand.

The OPEC+ oil output capacity held off the market is an overhang traders see as a cushion against any consumption increase. Without it, higher consumption would push up oil prices in lockstep. The weight of current sentiment is for oil prices to work lower. Or at least until it becomes evident that OPEC+ must reverse its withheld capacity to keep prices from soaring, i.e., consumption rising.

The long-term case for oil remains in place. Oil prices are in backwardation because near-term prices are higher than long-term ones. The May 2024 oil futures contract traded slightly over $83 a barrel. For a year later, the price is about $75, and two years out it is $70. Such price levels ensure healthy profits for oil producers.

If oil prices rise higher, expect the Biden administration to release oil from the Strategic Petroleum Reserve to dampen gasoline prices like it did in 2021. Both oil prices and regular gasoline pump prices are 55 percent higher than when President Joe Biden was inaugurated. He needs those prices lower to improve his re-election chances.

Geopolitical risk premium disappears but long-term economic case strengthens.

NATURAL GAS

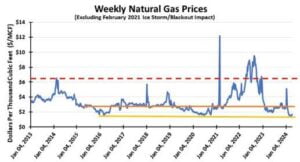

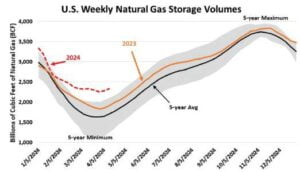

Although winter weather returned, the duration was brief. Gas for home heating barely benefited. Before and after the cold spell, temperatures were not high enough to necessitate increased air conditioning forcing utilities to fire up natural gas generators. The combined weather trends contributed to natural gas storage levels soaring to record levels.

As the accompanying chart shows, gas volumes in storage are well above the 5-year highs. Unsurprisingly, natural gas prices languish at low levels—about the low of the past decade.

The Energy Information Administration (EIA) forecast that continued mild weather conditions will lead to high natural gas storage volumes through 2025, meaning little hope for a recovery of gas prices. Producers need no encouragement to store gas in anticipation of substantially higher prices next winter. The US is swimming in natural gas supply.

What will change the gas price outlook? Only a reduction in gas production. A consumption surge can be handled by current output and gas volumes already in storage. The most recent estimate of daily US dry gas production is 99.4 billion cubic feet (bcf), down from 101.4 bcf a year ago. The EIA estimates production to average 103 bcf/d in its 2024 Short-Term Energy Outlook. Any estimate reduction could spark a rise in gas prices, but we doubt a revision will happen before mid-year.

In the meantime, the most telling information about how swamped the nation is with natural gas comes from the Permian basin in West Texas. The nation’s three largest sources of natural gas are the Marcellus (WV, OH, PA, NY), the Permian (TX, NM), and the Eagle Ford (TX) in that order. Last year, the Permian experienced the largest production increase of 2.6 bcf/d, over twice the output growth of the Marcellus and three times that of the Eagle Ford.

The major problem gas-producing regions are experiencing is adequate pipeline capacity to take away the output that constrained Marcellus’ growth last year to only three percent. The Permian basin faces a similar problem compounded by it being the nation’s largest oil-producing region. Significant associated gas flows accompany the growing oil output. In recent weeks, producers paid pipelines $3/mcf to take the gas output. Thus, oil producers lost over $1/mcf on the sale of the gas that would limit their oil output. Thankfully, oil prices are high, offsetting the gas losses. A petroleum industry irony.

Record gas storage volumes have sent prices to decade lows.

This story was originally featured in ON&T Magazine’s May 2024 issue. Click here to read more.