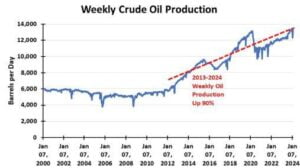

Recently, crude oil prices strengthened with WTI nearing $80 a barrel. Global oil market forecasts suggest more oil will be needed this year, but the increase will be half of 2023’s growth.

OPEC+ continues to hold the global oil price reigns by continuing to restrict its supply. The disruption of Middle East oil shipping routes due to Houthi missile and drone attacks is disrupting the market. Rather than transiting the Red Sea and Suez Canal, oil tankers must travel around Africa to be safe, adding weeks to their journeys, boosting transportation costs, and delaying the arrival of oil cargo in Europe.

With non-OPEC oil-producing regions showing slowing supply growth, including the US, the future supply and demand picture is again being examined. In the very short term, OPEC+ is the only option. Occidental Petroleum CEO Vicki Hollub told CNBC recently, “We’re in a situation now where in a couple of years’ time we’re going to be very short on supply.” Her view is based on the lack of reserve replacement experienced during the past decade.

The latest concerns about future oil supply growth involve two divergent factors. First, explorationists suggest that once the huge Guyana and Brazil deepwater discoveries are developed, they do not see other prospects with similarly large reserves.

The second issue is receiving greater attention because it is in the financial news headlines: M&A. The oil and gas industry is in an active phase of industry consolidation. While the merger and acquisition wave began at the top with ExxonMobil and Chevron buying competitors with specific assets highly complementary to each acquirer’s strategic business plan, it is now moving down the industry pyramid.

Natural gas markets are desperate for colder or hotter weather.

ExxonMobil added to its Permian Basin acreage which increases its ability to grow production via applying its shale oil technology to more wells. Chevron purchased Hess Corporation which adds several producing assets with the key one participation in Guyana’s huge reserves.

Lately, the industry’s M&A is enabling small and mid-sized exploration and production companies to increase scale, improve balance sheets, and better position themselves for growth while boosting financial returns. These ingredients will be important for the industry to increase output to meet the world’s needs. What our chart shows is how dramatically the US oil industry has been able to increase production over the past decade. This growth has changed the energy profile of the United States and helped restrain global oil prices.

The conditions that have made oil prices more volatile are not going away anytime soon. They may never go away. However, the industry is demonstrating that growth at any cost is a poor business strategy. A better one is to adopt a disciplined investment plan with reduced financial leverage. The latest M&A wave confirms that these principles are being embraced for the good of shareholders and the public.

NATURAL GAS

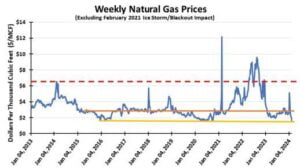

The ending of devastating cold weather along with surging gas storage volumes caused natural gas futures prices to crash—hitting a decade-low of $1.52 per thousand cubic feet. In early February, gas prices fell below $2/Mcf in response to forecasts of an early arrival of spring weather, the federal government’s pause of new liquefied natural gas export terminal approvals, and sustained high gas output. Things only got worse, resulting in the recent price crash.

Jeremy Knop, CFO at EQT, the nation’s largest gas producer told investment analysts on an earnings call, “The market is asking for not only production curtailments, but also activity reductions,” in response to the collapsing gas futures price. EQT responded by reducing its production.

Additionally, two other large gas producers—Comstock Resources and Antero Resources—announced they were dropping active drilling rigs, cutting their exploration budgets, and one company also suspended its dividend in response to the low gas prices. They indicated reversing these actions depends on higher prices.

Remarkably, on the same day gas futures touched their decade low price, major producer Chesapeake Energy announced cutting back on completing wells and reducing capital spending. Management commented that the actions were responding to an “oversupplied” gas market, but they are prepared to “return production in a measured fashion” in response to an improvement in demand which they expect will come.

Gas prices jumped 12 percent the following day along with a seven percent rise in Chesapeake’s stock price. Investors believed gas prices had hit bottom and would provide higher prices in the future. They point to the announced actions of these large gas producers to slow supply growth. It will be only a matter of time before prices recover, they believe.

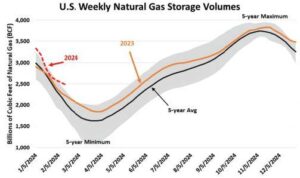

Our chart of gas storage shows volumes flirting with the 5-year maximum. This reflects the absence of winter demand that has left the industry with substantially more gas in storage, which reduces the need for more supplies to store for next winter. The US gas storage problem is compounded by high storage levels in Europe and Japan, key gas-consuming markets. Japan’s situation has developed as it restarts its nuclear power plants and reduces LNG purchases.

The problem gas producers confront is the absence of weather-related demand as they are gearing up their productive capacity for the “step change in demand in 2025 as incremental LNG capacity comes online,” as explained by Chesapeake’s CEO. Expect natural gas prices to continue to struggle until the heat of summer arrives and demand potentially soars.

Short term and long term supply/demand concerns create volatility.

This story was originally featured in ON&T Magazine’s March 2024 issue. Click here to read more.