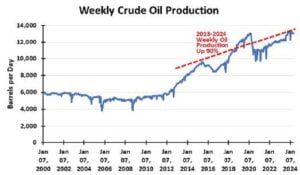

US oil production, as estimated by the Energy Information Administration (EIA), continues at 13.1 million barrels per day. Independent analysts question if production is that high, given the multitude of restraints on output caused by associated natural gas takeaway problems. When both oil and gas are produced from a well, both hydrocarbons must be moved to market for the well to operate. Increasingly, there are pipeline hookup challenges for the associated gas output. Those limitations are usually because a pipeline needs high volumes to justify adding new capacity or expanding the existing pipeline capacity. Interim solutions involve temporary hookups to pipelines with spare capacity, but they are not a permanent solution.

From a macro view, oil prices are driven by global oil demand. With the US summer driving season underway, Memorial Day’s weekend travel set records suggesting petroleum consumption over the long weekend was strong. Will it continue for the summer? Traders will be watching for signs of demand strength or weakness, and they will respond by pushing up oil prices or sending them down. One ingredient in current oil pricing that seems to have little impact is the geopolitical risk premium. It impacted oil prices last fall following the October 7 Hamas attack on Israeli citizens and communities, killing 1,200 and seeing 240 kidnapped. Oil traders expected a vicious response from the Israeli military following the attack. They saw a risk the response could spark a regional confrontation involving Iran and its proxy militias. When that did not happen, the risk premium nearly disappeared. Since then, the war risk premium has ebbed and flowed as different battles were waged. Major Israeli allies backed the country but they are slowly backing away from their support because of the brutal door-to-door fighting necessary to eradicate Hamas.

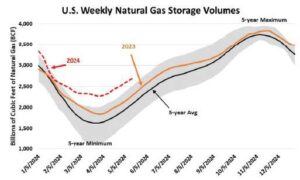

Natural gas market still oversupplied while awaiting air conditioning demand, more LNG, and stronger economic consumption.

As the erosion of Western support for Israel gains traction, Israel made progress in destroying Hamas strongholds in Gaza. Maybe an end to the military action is on the horizon. However, across the Arabian Gulf, Iran acknowledged it is accelerating its efforts to develop a nuclear weapon. Not a positive development for peace. Suddenly, a helicopter crash killed the Iranian president and its foreign minister. The president was considered the leading candidate to replace the country’s current supreme leader, 85-yearold Ayatollah Ali Khamenei. Whether a power vacuum could lead to greater instability in Iran is unknown, but its possibility could impact crude oil prices.

Oil prices depend on demand trends, but one cannot rule out how geopolitical events could explode the price if traders see an increased risk of oil supply disruptions. The most likely scenario is for oil prices to continue their roller-coaster journey within the guardrails of too cheap and too expensive.

NATURAL GAS

Natural gas storage volumes remain above their 5-year maximum. That is because production remains healthy while demand is subdued since summer heat has only appeared in isolated areas. Annual maintenance of the nation’s liquefied natural gas export terminals has cut their feed gas demand. When that happens, those volumes back up into the production system creating additional supply indigestion.

Without widespread air conditioning load, currently, there are few sources of gas demand to push up prices. Therefore, they continue languishing, but at higher levels than earlier this spring. Current gas prices are about $2.50 per thousand cubic feet, which is over a dollar higher than the late April low price.

At April’s low gas price, producers with no options were left with sending gas to storage, assuming customers would purchase it. Since some wells cannot be throttled back or shut in, producers opted to take whatever price they could obtain. The problem producers faced was that in some supply basins, the prices of gas had crashed. In the Permian Basin, the nation’s largest crude oil producer but a huge source of associated natural gas volumes, gas prices turned negative. Producers had to pay buyers—pipelines or industrial customers—to take their gas. That seldom happens. When it does, it lasts briefly, corrected by market forces. This negative pricing episode continued for longer than normal. Oil producers, selling their output for high $70s to low $80s a barrel prices, were willing to absorb negative gas prices to be able to sell their oil. This is a rare market dynamic that travels below the radar screen.

Crude oil prices rallying as demand is stronger and the geopolitical risk premium returns.

Summer gas price dynamics will revolve around the weather and LNG exports. A stronger US economy will boost gas consumption for power generation and chemical feedstocks. We know LNG feed gas demand will return once terminal maintenance is completed and shipments resume. That will help the supply/demand balance and should provide support for gas prices until air conditioning demand boosts electricity generated from natural gas. Until then, we do not expect much movement in gas prices. However, a tropical storm or hurricane, depending on its path and severity, could impact both gas demand and supply with appropriate price responses. Predicting storm impacts is impossible.

This story was originally featured in ON&T Magazine’s June 2024 issue. Click here to read more.