The May Consumer Price Index showed an 8.6 percent annual increase, up from the 8.3 percent increase reported for April, both 40-year highs! Other economic measures—Producer Prices, Retail Sales, Home Builder and Consumer Sentiment indices, and Mortgage Applications—also reflect high inflation’s impact on a weakening economy. If the country is in or headed for a recession, how severe will it be? For oil, the worse the contraction, the more pessimistic the outlook.

While uncertainty over the economy dominates the news, oil prices are also buffeted by the latest COVID-shutdown in China, potential recession throughout Europe, and the global ban of Russian oil use due to its invasion of Ukraine. Each event impacts oil’s use, but importantly each disrupts longstanding global crude oil trading patterns, often creating logistical issues for countries, causing oil prices to rise more.

As our accompanying chart shows, oil prices jumped nearly $35 a barrel in late February when Russia invaded Ukraine. Within days, much of that rise evaporated when it became evident Russia was not going to cut off its fossil fuel flows to Europe. Later the West launched a boycott of Russian oil, but its scope was limited by the challenges European countries face in finding alternative oil supplies. Faced with oil sale bans, Russia discounted the price and sold more output to China and India who were willing to buy cheap “black market” oil in defiance of the anti-Russia sentiment.

With geopolitical events shaping commodity traders’ oil price outlooks, the global economic recovery continues pushing demand higher while OPEC and U.S. producers struggle to find more supply. Energy company shareholders are demanding producers reinvest less in their businesses and return more cash to investors, slowing oil supply growth. Furthermore, global refining capacity has shrunk due to historically poor financial returns and the massive investments needed for upgrades. Therefore, both crude oil and refined product markets remain tight at the same time, an unusual situation.

Limited gasoline and diesel fuel supplies are problems for politicians and consumers. For consumers it means sky-high pump prices. For politicians, escalating pump prices promotes a voter backlash with elections on the horizon. Politicians are pressured to do something— anything. Demonizing and taxing oil companies is their default response. It will not work. The public understands better than politicians that there are no short-term fixes for these markets. Demand destruction is the only sure fix, which will come from higher oil prices and a recession. No one wants to pay that price, but it may be our future.

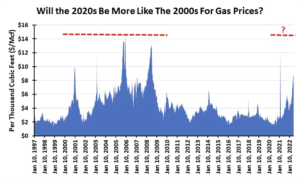

NATURAL GAS:

For months we have been telling readers that gas prices depend on developments in the global liquefied natural gas market, especially for the U.S. industry. The RussiaUkraine war forced European countries to re-examine their dependence on Russian fossil fuels, especially natural gas. Across Europe, the magnitude of Russian gas dependency, over one-third of gas use, shocked leaders. Dependency differed by country and their long-term commercial relationships with Russia. Neighbor countries were 100 percent dependent on Russian gas. Large economies such as Germany, Italy, and Poland got 40-50 percent of their supply from Russia. Even France, with its large nuclear power industry, received 25 percent of its gas supply from Russia. Only a few countries received no gas from Russia.

European Union members sanctioned Russia and tried to undercut its economy by banning fossil fuel purchases. That meant finding alternative supplies in a tight global gas market. Europeans turned to the United States for LNG and were willing to pay $30 per million Btus, or nearly six times US prices. A warmer winter and continued Russian gas flows eased Europe’s challenge.

The US is the world’s largest LNG exporter, accounting for 20 percent of the market. Europe’s gas desperation had it boosting US imports for the first five months of 2022 to 15 billion cubic feet per day, a 29 percent increase over the prior year’s volume. This was achieved because Asia cut back US LNG purchases since they would not match Europe’s high prices. Furthermore, Asian countries had the option to ramp up coal use in generating electricity at cheaper prices, ignoring carbon emissions increases.

A June 8th fire at the Freeport LNG terminal in Corpus Christi, Texas upended the global gas market. The fire closed the terminal, responsible for 20 percent of US LNG exports. The immediate impact was European gas prices rose nine percent, while U.S. gas futures fell six percent. Shutting the terminal for three weeks (initial estimate) meant less gas going to Europe and more production staying at home.

The incident signaled a tighter winter gas supply situation for Europe, but more supply for the US.

A week after the fire, Freeport LNG announced the terminal would be closed for three months, not three weeks, and its full operational capacity would not be restored until the end of 2022. With three-quarters of US LNG shipments going to Europe, the continent is scrambling for new alternative supplies. At 2 Bcf/d of production, 90 days of output adds an additional 180 Bcf of U.S. supply, shrinking the current 300 Bcf winter storage shortfall and lowering the odds of winter supply problems from 40 to 25 percent.

The US gas market remains captive to global LNG demand, which continues growing. Increases in US gas production, this summer’s heat, the potential for Gulf of Mexico hurricane disruptions, and the amount of electricity generated from coal-fired plants will determine natural gas prices this summer. Barring future incidents like the LNG terminal fire, we expect gas prices to continue trading in the $7-9 per thousand cubic foot range. Don’t expect current high gas prices to drop appreciably anytime soon.

This story was originally featured in ON&T Magazine’s June 2022 issue. Click here to read more.